Tax Preparer Resume

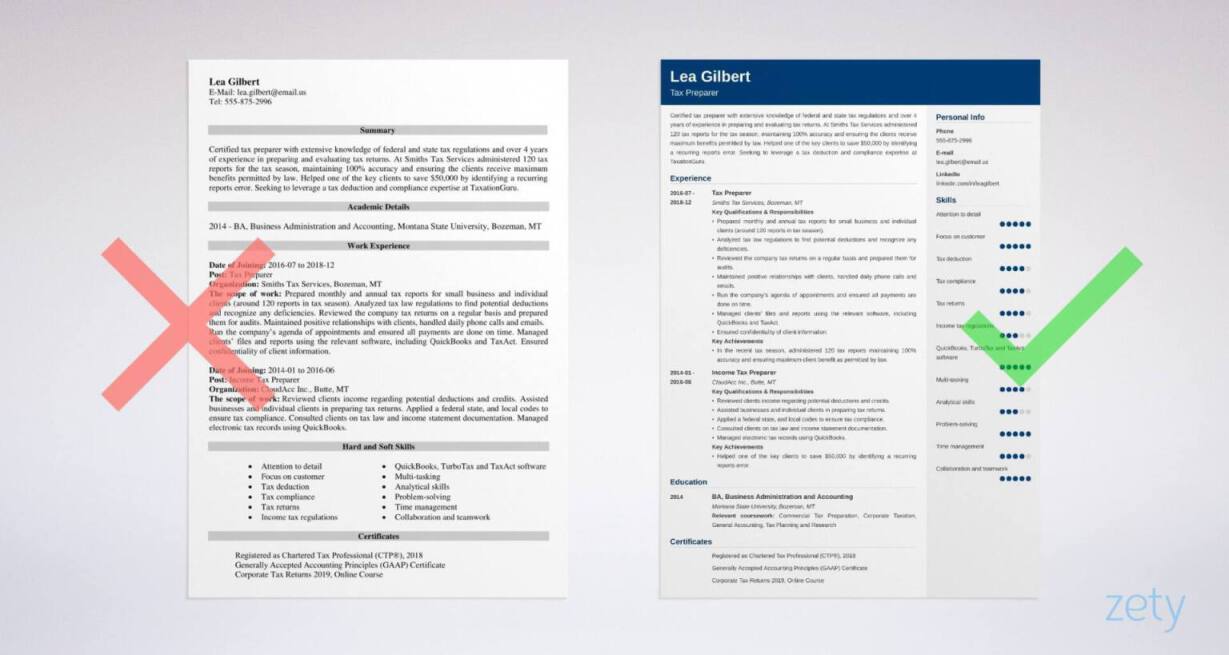

When looking at your resume hiring managers want to see how you demonstrate these skills. Although this job seeker has only held a few positions.

Tax Preparer Resume Example Useful Tips Myperfectresume

Start a free Workable trial and post your ad on the most popular job boards today.

. When reviewing resumes for a Tax Preparer look for some form of formal training in accounting practices. From 12 an hour. Having a widely recognized certification in accounting improves your resume and helps land you better jobs.

Happiness rating is 77 out of 100 77. Sign the income tax return. Processing Delays for Paper Tax Returns.

Pandemic-paused IRS return preparer visits could resume by video AICPA recommends changing cryptoasset question In a comment letter to the IRS the AICPA recommended changes and clarifications regarding the. Tax Preparers should include information on their tax preparation certification if they live in a state where it is required. Pronto Tax School is an online tax school on a mission to make the lives of tax professionals easier and more profitable.

Kforce is a professional staffing services firm specializing in flexible and direct hire staffing in Technology and Finance Accounting engaging over 23000 highly skilled professionals annually with more than 4000 customers. Tax practitioners have long served an important role in our nations tax collection system as a conduit between taxpayers and the IRS. Hourly will fluctuate with season.

If you already filed a paper return we will process it in the order we received it. They also work with a Tax Preparer to calculate tax credits deductibles and liabilities. Do not sign the income tax return exempt tax preparer is the responsible party No.

IH 35 Stop 6380AUSC Austin TX 78741. IRS Acceptance Agent Training Slideshow 3. The Title or Header in a resume refers to a condensed phrase that lists your exceptional skills relevant to the job duties sought by the hiring managerAn ideal resume header impresses the reader right away by briefing multiple professional accomplishments in one introductory phrase.

IRC 6694 Understatement of Taxpayers Liability by Tax Return Preparer. Local Government Tax Guide. Tax accountants manage tax obligations of companies and individuals prepare tax documentation and assist clients in taxation audits.

New Tax Manager jobs added daily. Internal Revenue Service 3651 S. As a student you will interact with the.

The Practitioner Priority Service PPS is your first point of contact for account-related issues. Work for a CTEC registered tax preparer. IRS form 13551 Instructions 4.

Complete CAA application Form 13551. Employers Post Job. It specializes in providing relevant convenient not boring online tax courses.

Work seasonally and earn a high income with our approved CTEC 60 hour and 20 Hour qualifying tax preparer courses. If agreement to either continue the suspension or to resume the examination activity on the case cannot be reached at the group or territory level the issue will be. Mail all items to.

Seasonal Job Education American Real Estate University Certificate and Designation Short SalesBPO REo Sales. Welcome to the Paid Preparer Due Diligence Training. Heres how to write a tax accountant resume that proves youre a vital asset.

An online toolkit that provides step-by-step guidance through resume templates cover letters thank you letters and more. During tax season Feb - Apply Now. Take income tax data from a client and enter it into a computer whether in person or other.

Mid-career Finance Resume Example. 13 - 15 an hour. Mason Enterprise Center 4031 University Drive Fairfax City VA 22030.

Start of main content. Work for an exempt tax preparer. Print and sign last slide.

They trust Pronto to provide the training. Accounting Resume Headline Examples. Previous bookkeeping experience and experience filing taxes.

Leverage your professional network and get hired. A job seeker with several years of finance experience should use a combination resume format to emphasize both work history and skills in equal measure. Small CPA Firm in Herndon VA seeking a Junior Tax Preparer to support preparation of individual and small business tax returns.

Mid-career Finance Resume Example. Located first on the resume-page your headline. Prominently display your education certifications.

Tax professionals trust Pronto for regular annual online tax preparer continuing education courses. Follow these five resume writing tips to create a winning accountant resume that reflects your professional background skills and expertise in managing a companys finances. Our Practitioner Priority Service is a professional support line that staffed by IRS customer service representatives specially trained.

The course content in our tax preparer training is designed to teach the knowledge and skills that professional tax preparers actually use on the job in the real world. 41 out of 5 stars. Tax Preparer HR Block Dec 2001 - May 2002 6 months.

Taxpayers should file electronically through their tax preparer tax software provider or IRS Free File. What should you look for on a Tax Preparers resume. Complete IRS ITIN Tax Law training.

Complete fingerprint cards If not ERO EA CPA Attorney etc 5. Choose the Best Format for Your Tax Accountant Resume. Short-term capital gains are taxed at ordinary income tax rates up to 37 the seven marginal tax brackets are 10 12 22 24 32 35 and 37.

Hiring Tax Accountant job description Post this Tax Accountant job description job ad to 18 free job boards with one submission. Todays top 45000 Tax Manager jobs in United States. We offer you the best in tax education.

Williams and his co-defendant lawyer Nicole Burdett are accused of conspiring with confessed tax cheat Henry Timothy to reduce Williams tax burden by more than 200000 over five years. The Paid Preparer Due Diligence Training helps you as a tax preparer better understand the earned income tax credit EITC child tax credit CTC additional child tax credit ACTC credit for other dependents ODC American opportunity tax credit AOTC head of household HOH filing status and your responsibilities. Yes or you must resumebecome an active California CPA.

Were experiencing delays in processing paper tax returns due to limited staffing. Follow these three tips to write an accounting internship resume that lands you an opportunity to gain some hands-on experience. Your tax accountant resume needs to prove that you can deal with complex.

On the other hand long-term capital gains. Local License Renewal Records and Online Access RequestForm 4379A Request For Information or Audit of Local Sales and Use Tax Records4379 Request For Information of State Agency License No Tax Due Online Access4379B. IRC 6695 Other Assessable Penalties With Respect to the Preparation of Tax Returns for Other Persons.

Tax Preparer Resume Example Useful Tips Myperfectresume

Tax Preparer Resume Examples Finance Livecareer

Tax Preparer Resume Example Useful Tips Myperfectresume Recipe Good Resume Examples Resume Examples Accountant Resume

Tax Preparer Resume Samples Qwikresume

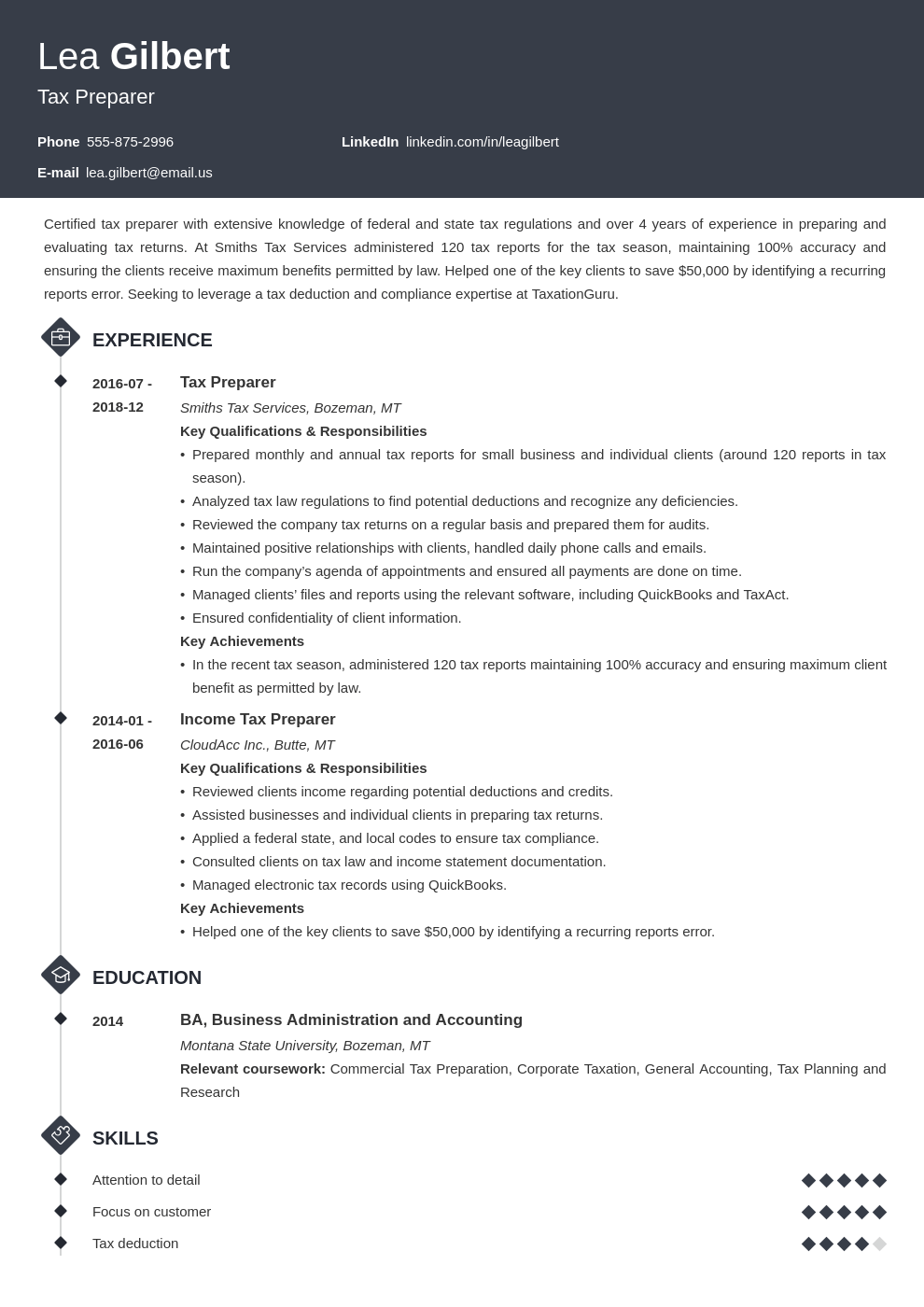

Tax Preparer Resume Sample Writing Guide 20 Tips

Income Tax Preparer Resume Example Kickresume

Tax Preparer Resume Samples Velvet Jobs